Cat Insurance – Pet Insurance claims for cats

How much could your cat’s health realistically cost you?

The general consensus is that owning a cat is a lot cheaper than owning a dog. While this may be true, there are many potential hidden costs that come with cat ownership too. Budgeting for toys, cat food and flea medication is all very well, but what is harder to prepare for is the often unforeseen costs that will arise, mostly concerning your cat’s health.

While it’s expected that each cat will need some degree of veterinary care at some point throughout their lives, it is difficult to account for the more serious illnesses that can, and commonly do develop in cats as they mature. Although it’s true that dogs will (on average) cost more to care for over their lifetime, cats with serious health conditions will cost a substantial amount of money to care for too.

While it’s expected that each cat will need some degree of veterinary care at some point throughout their lives, it is difficult to account for the more serious illnesses that can, and commonly do develop in cats as they mature. Although it’s true that dogs will (on average) cost more to care for over their lifetime, cats with serious health conditions will cost a substantial amount of money to care for too.

Cats do tend to have fewer veterinary visits overall, but when they do have an accident or contract illness, treatments can still run into thousands of dollars.

Outdoor cats are more at risk when it comes to health concerns simply because they are exposed to more. They encounter other animals, different insects and different foods or substances. They also tend to climb in places that are not as safe as being indoor and they can potentially end up near roads.

Having said that, this does not mitigate all the risk for indoor cats. Accidents can happen indoors and being indoors does not provide protection from common cat health issues.

Since cats are more sedentary by nature and can be good at hiding symptoms (compared to their canine counterparts) it is often difficult to pick up if that something may be wrong. Often, if left too long without going to a vet, their condition can deteriorate, and you may be left with a very ill cat that requires expensive vet care.

Common cat health conditions and costs

Some of the most common healthcare costs for Aussie cat owners in 2022 were for vomiting, gastrointestinal conditions and dental disease. Here is the breakdown of some average and highest claim costs for a variety of health conditions experienced by cats during 2022, according to Petsure’s claim figures.

| Average cost* | Highest cost* | |

| Vomiting | $636 | $9,464 |

| Gastritis | $627 | $13,862 |

| Dental disease | $815 | $4,928 |

| Diarrhoea | $375 | $8,836 |

| Feline Lower Urinary Tract Disease | $1,330 | $19,414 |

| Ear infections | $347 | $7,771 |

| Osteoarthritis | $357 | $5,387 |

| Skin allergies | $451 | $4,990 |

| Bite injury | $695 | $11,350 |

| Constipation/ obstipation | $2,408 | $25,687 |

| Diabetes mellitus | $1,208 | $41,947 |

| Heart disorder | $1,060 | $6,764 |

| Urinary bladder stone | $1,796 | $14,634 |

| Tick paralysis | $1,859 | $20,348 |

*Based on PetSure claims data, 2022 calendar year. Reimbursement for these claims under a pet insurance policy, would be subject to limits, such as annual benefit limits or sub-limits, benefit percentage, applicable waiting periods and any applicable excess. Cover is subject to the policy terms and conditions. You should consider the relevant Product Disclosure Statement or policy wording available from the relevant provider. Please note that values calculated are based on all claims for that condition and medically related conditions in each calendar year.

As you can see from the above table, some of the claims for cat health conditions can be very significant, with the highest claim cost being a hefty $41,947 for diabetes mellitus. Other conditions such as FLUTD, constipation / obstipation and tick paralysis were also very costly for cat owners in 2022.

What does this mean for our pets and our pockets?

Pets experience accidents or illness at any age, with PetSure research showing the lifetime cost of owning a pet is around $30,000.

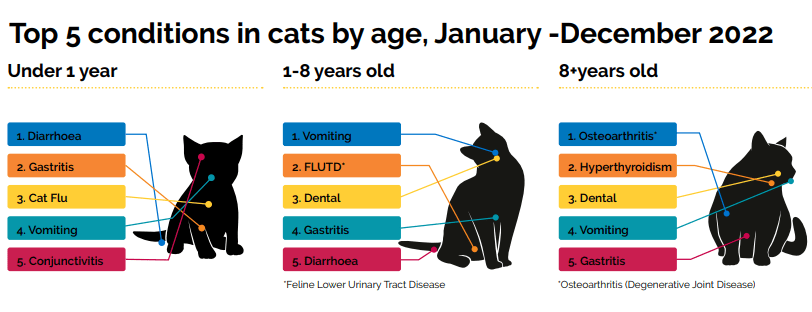

The researchers also revealed the most common health conditions for dogs by age category:

- For cats aged under 12 months – diarrhoea

- For cats aged between 1 and 8 years – vomiting

- For cats aged over 8 years – osteoarthritis

Why is cat insurance important?

Since there is no Medicare for cats, it is often difficult to fund large veterinary fees if an unforeseen event occurs, particularly when it is a serious accident or illness that can end up costing thousands. Pet insurance is an affordable way for owners to plan ahead for unexpected veterinary expenses. This is usually why owners choose to insure their cats as the other alternative is not a pleasant one (the reasons why pet owners choose euthanasia is if there is really no way to treat your cat or if the cost is not affordable for the pet owner).

Unsure how serious it is?

Bow Wow Meow policyholders can get access to trusted vet care anytime, anywhere, at no additional cost. Connect to an experienced Australian registered vet via video call, 24/7. Whether it’s providing vet advice, setting up at-home treatment plans, or confirming if you need to visit a vet in person, you can get help when you need it.

Find out more about our pet insurance cover options.

When is the best time to insure a cat?

If you are a new kitten owner that is contemplating pet insurance, know that the best time to obtain pet insurance is when they are young and have no pre-existing conditions. If there are already existing health conditions (prior to getting a policy or within the 30 day waiting period), these will generally be excluded from cover. Kittens can be covered from 8 weeks of age and as they usually do not have any pre-existing conditions at this time, it is definitely a favourable time to get pet insurance.

Rememer that premiums typically rise each year as your pet gets older and is more likely to experience health issues.

Pet insurance means being prepared

Owning a pet is a long-term financial commitment. The best thing you can do as a loving pet parent is to know what costs could be around the corner in order to be prepared if your cat does become sick—you’ll most likely need a number of vet visits, maybe even a surgery and ongoing medications. Sadly, these costs can often be too much for people to afford.

If in doubt, the best way to prepare for any illnesses your cat may develop is to organise cat health insurance.

Because it is difficult to predict the costs of veterinary care, it can help to have measures in place to help prepare for the unexpected. Pet insurance can help by covering a portion of the eligible vet bill if the unexpected does happen. Many an owner can attest to just how life-saving cat insurance can be.

Bow Wow Meow Pet Insurance can help protect you and your cat should an unexpected trip to the vet occur.

-

Find out more about our cat insurance options

-

Get an instant online pet insurance quote

Pet Insurance reviews from cat owners